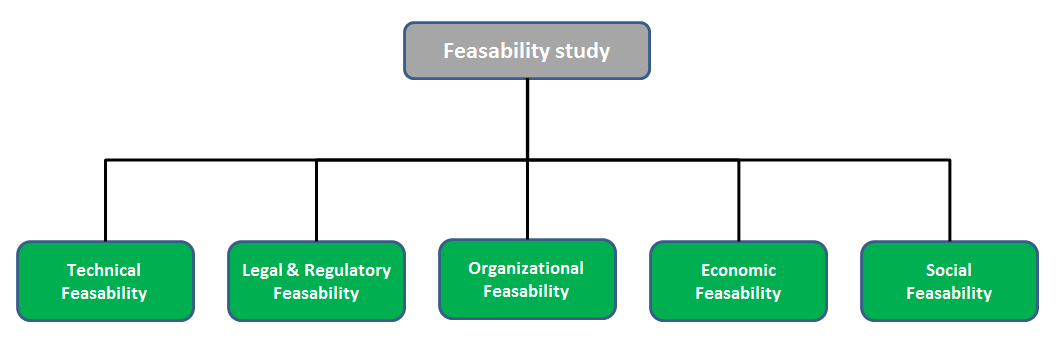

Feasability study of your infrastructure project

We analyze the viability of your project through a disciplined and documented process.

Our technical and economic experts will deliver a feasibility report of your project, including at least, but not limited to the followings: Product/Services & industry description, Technical feasibility, Market environment; Competition analysis; Business model; Market & Sales strategy; Production & Operations requirements; Management & Personnel requirements; Regulations & Environmental issues; Critical risk factors; Financial predictions such as balance sheet, income statement, cash flow statement, break even analysis and capital requirements.

Feasability study of your infrastructure project

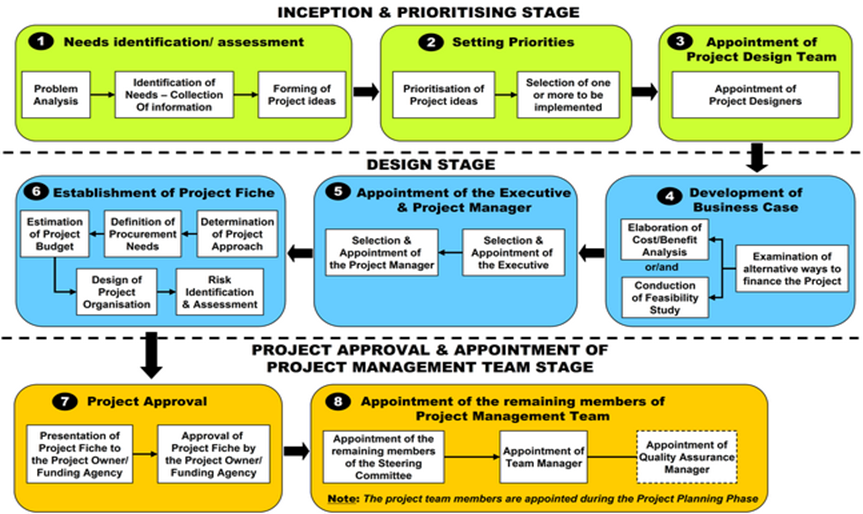

Perform your infrastructure business case analysis

We support our clients to maximize project returns by raising, structuring and negotiating debt and equity packages.

We prepare your due diligence on an infrastructure investment by performing a red flag analysis on relevant documentation. Our energy and infrastructure market and industry knowledge enables us to identify key issues beyond the analysis, and to take into account the latest or upcoming legal, technical, fiscal, regulatory or market changes.

Our financing expertise includes:

- Financial Advisory to Public and Private sectors

- Energy & Infrastructure projects structuration and funding arrangements

- Infrastructure debt and equity funding transactions

Project Finance

- Structured Finance

- Infrastructure Funding

- PPP Concession

Debt and Equity raising and structuring